What trends are Shaping Transportation Equipment Availability for 2022?

The economists have spoken. The US economy is heating up, people who stayed home and accumulated savings during the pandemic, now want to spend their cash. Consumer spending has mostly focused on tangible “goods”. Housing markets are hot and retail sales are soaring, while the recovery in the travel industry and commercial construction has been slower than expected.

We now find that manufacturing plants, the trucking and logistics industries, distributors, and the material handling capabilities at ports and railyards have not yet returned to their pre-Covid-19 pandemic capacity. Further complicating this is that most manufacturing companies reduced orders of raw materials and scaled back inventory and production during the pandemic due to a smaller workforce and lower forecasted demand. Now, they have an urgent need for these materials! With demand outpacing supply, the result is higher prices (inflation), labor shortages and a more selective workforce. As well as congestion and bottlenecks at ports, railyards and transportation hubs causing delays on orders of parts, raw materials, and finished goods coming into the USA.

The problem is highly visible with the holiday season upon us. 60 minutes ran a segment on Nov. 14th, 2021 called “Freight Expectations”. This segment focused on the extreme situations at the port of LA/Long Branch in California which has had backlog rates as high as 9 weeks. The program chose to emphasize finger-pointing among terminals, shipping conglomerates, rail yards, and the trucking industry. However, this episode leaves you hanging without proposing solutions.

I decided to dig a little deeper since one of the fingers from the episode above pointed at the lack of transportation equipment, specifically the numerous chassis buried under stacks of unmoving shipping containers.

Chassis Equipment Outlook

The bottom line is, it’s true, chassis are difficult to procure in many regions. And don’t expect the supply of available chassis to increase anytime soon. Deliveries on orders for new transportation equipment are out 6 – 9 months, well into 2022. Shortages in steel / aluminum, microchips, and labor uncertainty throughout the supply chain make it difficult to accurately estimate delivery dates. These shortages also mean repairing existing fleet chassis takes longer and is more expensive due to a limited supply of required parts. In addition, chassis have longer dwell times at ports and railyards. The same is true for both container and bulk liquid chassis.

What the Economists are Saying About Transportation Equipment for 2022?

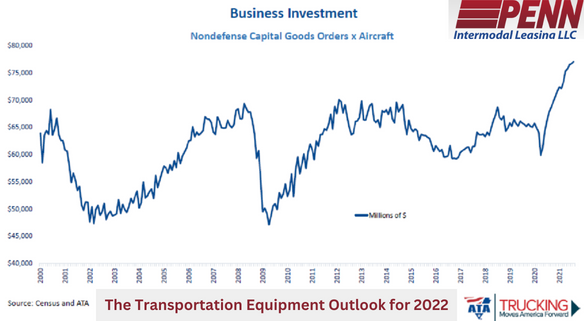

Macro-economic models from ITR Economics presented at the DVIRC Manufacturing Summit and the presentation by economist Bob Costello at the American Trucking Association (ATA) during the NTTC Tank Truck Week (October, 2021) indicate that it’s going to take some time to work through the log-jam.

These economists anticipate a gradual slowdown in the rate of growth in late 2022 – 2023 “normalizing” the supply chain. This slowing of demand is seen as a positive in order to give supply chains a chance to catch up. Especially since the labor market is expected to remain tight, particularly in sectors like transportation and warehousing. The slowdown may be encouraged by a small rise in interest rates, which are expected to remain favorable.

This growth cycle is expected to continue for most of the decade with a slight pull back in late 2025 – 2026. However, these economic models were run prior to the emergence of the Omicron variant. The long-term impacts that the newest Covid-19 variant will have, if any, are yet to be determined.

Make the Most of the Growth Cycle

The economic models are based on macro-economic trends, your specific situation or experience may be different. However, for companies in manufacturing and distribution who anticipate a growth cycle and need to expand their fleet of transportation equipment recommendations include the following:

- Don’t wait! Get your orders in and make use of the assets.

- Once ordered, be patient.

- Expect higher prices.

- Consider the option of equipment leasing.

- Utilize older equipment for storage and get newer transportation equipment back on the road.

Penn Intermodal Leasing, LLC has been in the chassis leasing business for 30 years. We provide our customers with liquid bulk transportation equipment solutions during all phases of the business cycle. Call us at 888-909-PENN to discuss your specific needs.

Disclaimer

The information provided herein is not intended to replace or serve as a substitute for any legal, financial, or other professional advice, consultation or service. The prospective buyer should consult with a professional in the respective legal, accounting, or other professional area before making any decisions or entering into any contracts based on the information described above.