In 2019, bulk liquid transport trends were similar to recent years as transportation and supply chain infrastructure adapts to accommodate domestic industrial growth and the disruption caused by Amazon.com and other large e-tailers. A new urgency to climate change and the tight labor market also heavily influenced the industry pushing it forward and fostering an environment in which it is advantageous to rapidly adapt and innovate. If you want to understand the trends in the bulk liquid transportation industry read more.

Increased Capacity

The bulk liquid transport industry increased capacity in 2019. This increase includes increases in the number and size of tank trailers and tank chassis on the road as well as improvements in infrastructure and greater efficiencies in the supply chain. For example, a driver that has to wait an hour at the warehouse, is an hour of capacity that is going to waste. The rise of technological solutions including artificial intelligence has made bulk liquid manufacturers and transporters able to leverage data to improve efficiency, thus less waiting time, fewer empty return loads and thus an increase in capacity. Global capacity also increased in 2019 due to the push towards bulk liquid transport equipment with larger tanks and some regions allowing heavier loads. Improvements in equipment safety and durability, as well as more stringent standards, also result in fewer breakdowns and less downtime.

Carrier Consolidation

Companies that specialize in ocean vessel shipping, as well as trucking, supply chain and logistics companies, are consolidating to form larger enterprises from smaller carriers. These large carrier companies hold more of the market share than ever before and the mergers have rapidly changed shipper-carrier relations. Shippers are forced to adapt quickly as their formerly reliable relationships with their carriers are thrown into limbo and transportation operations rely on new and untested carriers. The remaining small carriers are faced with the daunting challenge of competing with the large, consolidated carriers with additional resources and efficiencies.

Drivers Wanted!

2019 saw recruitment efforts intensify and benefit packages increase from most trucking and shipping companies. The American Trucking Association estimated in a 2019 report that the industry needed to hire 110,000 new truckers per year to meet demand and make up for those leaving the industry. According to this same report, there is an estimated shortage of as many as 100,000 drivers in the bulk transportation industry slowing bulk liquid transport. Not only is the current driving workforce aging, but the industry has difficulty attracting and retaining new drivers. Recruitment has begun to focus on encouraging more women to participate in this traditionally male field, however, alternative jobs are available with better hours and do not require extended travel. Trucking companies are improving their benefits and restructuring travel routes in order to attract and retain drivers. Other proposed options to boost driver recruitment include pay increases, lowering the driving age, supporting drivers with more family time and initiatives to promote a more positive and inclusive image.

Growth in Rail Transportation

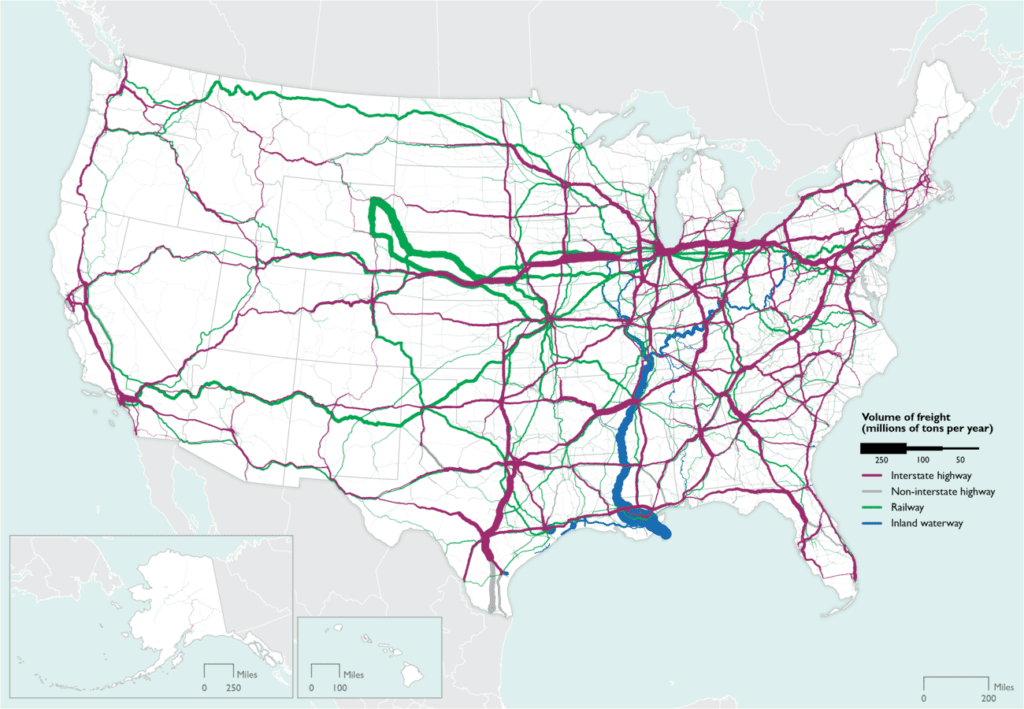

The U.S. Bureau of Transportation reports that the year over year for-hire freight shipments in November 2019 are up 1.0% from those in November 2018. For-hire freight includes rail, pipeline, truck and water freight. Much of the growth achieved in 2019 can be attributed to higher rail freight volumes. The freight industry has seen steady growth in bulk chemical transport via rail for several years, and the growth in this sector is predicted to continue in the short term due to its safety, efficiency and ability to transport high volumes. However, rail is predicted to fall in the long term due to the low prices of fuel, the expense of constructing and maintaining rail lines, and new technologies that have made truck transportation more fuel-efficient and better for the environment. Also, with the effects of climate change expected to bring more extreme and unpredictable weather, rail may become unreliable in cases of snow or ice, where trucks are needed to pick up the slack.

Are you looking for an expert on leasing bulk liquid transport equipment? Contact Penn Intermodal Leasing LLC today to connect with industry leaders.