Here is a look at the Three Largest U.S. Ports, and the issues they face.

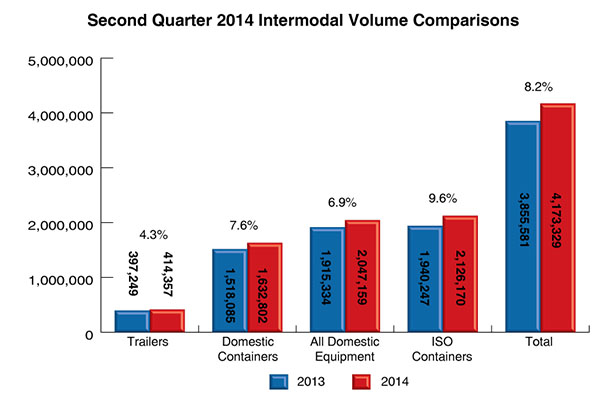

- 9.6% international container growth

- 4.3% trailer growth

- 7.6% domestic container growth

The Intermodal Association of North America (IANA) recently reported that a rebounding economy, higher import volumes, and an exceptionally rough winter are factors that combined to make the second quarter of 2014 the largest intermodal container growth quarter since 2011. See IANA’s Intermodal Market Trends & Statistics report for details

Containerized shipping, particularly intermodal shipping, continues to expand in order to meet the increasing demand for goods in a gradually improving economy. However, even this unprecedented Q2 growth was constricted, in part, due to chassis availability. The need to meet growing chassis demand is one of the greatest challenges for U.S. ports and the intermodal industry.

While ocean carriers’ divesting of chassis ownership has been the driving force behind the changing chassis landscape and the resulting inadequate availability of quality chassis, there are five (5) additional challenges that the largest ports are facing that also contribute to the continued chassis shortage. They include:

- The slow growth of the container freight transport industry relative to the growing demand for goods,

- Aging chassis fleets,

- The need to transfer containers from one chassis to another for transport,

- Chassis maintenance and repair costs, and

- Bundled services from ocean carriers to shippers that limit chassis leasing options due to a fear of non-payment when a non-bundled chassis leasing firm is used.

Nowhere in the U.S. is this chassis shortage a more pressing problem than at its largest ports – the ports of Los Angeles, Long Beach and New York-New Jersey. Terminals frequently run short of chassis during busy periods. Out-of-service chassis and billing problems are constant headaches. The current model of chassis pools without a clear plan for broad chassis availability is exacerbating the problem.

Short-term chassis shortages lead to delays, which are then compound resulting in more shortages and delayed delivery times. This cycle, coupled with the growth of containerized shipping, bigger ocean carriers and an aging fleet of chassis results in difficulties with on-time freight transport. Despite the challenges, chassis leasing firms are cooperating to explore innovative approaches.

One example is the planned southern California cooperative leasing pool organized by three companies which lease standard chassis. This southern California chassis pool proposes to interchange a total of 68,000 chassis at 11 terminals. Essentially, this would allow any one of the chassis from these three chassis leasing companies to be picked up and dropped off at any of 11 terminal destinations throughout the ports of Los Angeles and Long Beach.

Maintenance and repair responsibilities and fleets consisting of a large percentage of chassis near the end of their effective lives are additional issues that need to be resolved for the above model utilizing an extended chassis pool approach to be effective.

As major west coast ports experiment with the chassis “interchange” concept, east coast ports, like the Port of New York-New Jersey, have yet to put forward a viable plan for a cooperative approach among chassis providers.

The concept of a modified or extended chassis pool “interchange” that would allow customers to pick up and return chassis at any location serviced by any of the chassis providers is still in the testing stage. It remains to be seen whether chassis providers can overcome legal hurdles, such as justice department clearance and the larger issue of competing interests among leasing companies, ocean carriers, truckers and cargo interests.

One thing that intermodal industry leaders agree upon is the need to develop multiple solutions rather than forcing the entire industry to fit one model. For now, non-pool affiliated chassis leasing companies are increasingly filling the gap for trucking companies during this transition period.